Additionally if you are operating your business worldwide and having the major clients from different parts of the world. Courses Finance Accounting Money Management Tools Excel Bank Reconciliation VAT on Excel. This area of VAT compliance continues to be a very serious focus and accordingly we advise vendors to ensure full compliance with the VAT laws. These spread-sheets have all the functions of the standard spread-sheets but also prepare the figures required for your quarterly VAT returns. Rhodam Posted February 14 2012. The first year accrual output VAT accords with the annual turnover. SARS has issued an instruction to all its offices to target VAT vendors by reconciling its VAT return turnover reconciliation figures to its financial statements. The amount of Input VAT is deducted from Output VAT to determine VAT payableClaimable. UK VAT Taxable Turnover Calculator is a ready-to-use excel template to calculate the value of goods sold during the past 12 months for registration purposes. When you buy through links on our site we may earn an affiliate commission.

However the second year accrual output VAT is less than the corresponding annual turnover. If the amount is above the threshold. VAT stands for Value Added Tax and the invoice mentions the details about how much tax is to be applied for a particular item or the service rendered. Unexpected manual journals Monthly EC Sales reconciliation to VATrevenue GL balances Training documentation eg. They do not allow for prior period adjustments and processing that does have an effect on the VAT liability. Monthly Bank Reconciliation Template. To simplify the process we have created a simple and easy UK VAT Taxable Turnover Calculator to calculate taxable turnover for registration purposes in just a few minutes. The first year accrual output VAT accords with the annual turnover. If one or the other needs adjusted because theyre wrong then post the adjustments or list. When you buy through links on our site we may earn an affiliate commission.

Enter your financial details and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting. The VAT invoice is a document that notifies an obligation to make a payment. These spread-sheets have all the functions of the standard spread-sheets but also prepare the figures required for your quarterly VAT returns. When you buy through links on our site we may earn an affiliate commission. Rhodam Posted February 14 2012. Additionally if you are operating your business worldwide and having the major clients from different parts of the world. The reconciliation is performed by confirming that the total output tax as declared in the VAT201 is equivalent to the total turnoverrevenue for the same period and that the total input tax deducted in the VAT201 is equivalent to the total purchases and expenses for the same period. However I have a reconciliation that I have been using for the last ten years in Excel this is a very useful tool as most accounting software packages only report on the 2 months or 1 month that you pull for the report. Download Free UK VAT Templates in Excel. This area of VAT compliance continues to be a very serious focus and accordingly we advise vendors to ensure full compliance with the VAT laws.

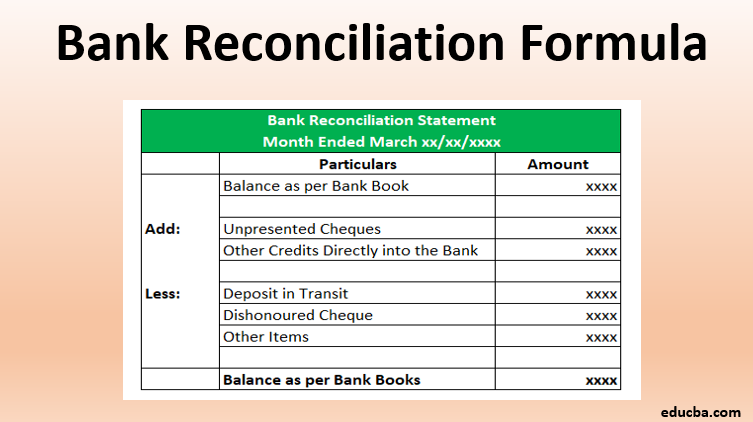

Monthly Bank Reconciliation Template. For those registered for VAT and using standard VAT accounting. Enter your financial details and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting. So it is reconciled. Now add more details in your invoices and make them simple to read for online or face-to-face customers with cash book with VAT excel template now. Hello I am trying to reconcile the years VAT returns with the annual accounts turnover which is a standard reconciliation for accountants. Courses Finance Accounting Money Management Tools Excel Bank Reconciliation VAT on Excel. A registrant or registered taxpayer means a taxable person who is registered for VAT and is required to charge VAT and. Enter the closing balance figures on VAT control accounts VI and VO from the summary trial balance report Enter the VAT figures on the VAT Return reports awaiting reimbursement. However the second year accrual output VAT is less than the corresponding annual turnover.

Enter your financial details and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting. Take the balance per the books the balance per wherever else the balance is the returns for VAT and then find out why the two numbers are different. Hello I am trying to reconcile the years VAT returns with the annual accounts turnover which is a standard reconciliation for accountants. Get More Excel Templates. Download UK VAT Taxable Turnover Calculator Excel Template. They do not allow for prior period adjustments and processing that does have an effect on the VAT liability. From a taxpayers point of view ensuring that all VAT has. A registrant or registered taxpayer means a taxable person who is registered for VAT and is required to charge VAT and. Monthly Bank Reconciliation Template. However I have a reconciliation that I have been using for the last ten years in Excel this is a very useful tool as most accounting software packages only report on the 2 months or 1 month that you pull for the report.